Read the original post here.

Delphine Constantin is the Founder and Managing Director of D Sy Law, where she helps facilitate trade and investment between Europe and Asia. In this interview with Asia Law Portal, she explains her practice and its network of offices and how she has adopted an innovative approach to legal services delivery and practice management.

You specialize in serving as a bridge between Asia and Europe for clients in investment and business transactions. Tell us more about this.

D Sy Law is an independent international law firm. We are based in Singapore and, together with our partner law firm MCE Legal, have four offices in Switzerland and two offices in France. We act for European investors in South East Asia (ASEAN) and in India – and for outbound Asian investors into Europe.

I have myself been practicing in Asia for 15+ years. I have lived in a number of the region’s jurisdictions, where I have held senior roles with international law firms. I was a Senior Consultant with one of India’s leading law firms in Mumbai, and a counsel with the Asian Development Bank in Manila – with which I continue to be involved.

This on-the-ground experience has given me a first-hand understanding of the local implications of the transactions we advise on. Our expertise is today sought across all regional economies – including Vietnam, Indonesia, and the Philippines.

D Sy Law has specific expertise advising on complex international projects in sensitive contexts. We have acted in a diversity of sectors such as infrastructure, energy, aviation, health-care, or agri-business. We advise on the development and financing aspects of our clients’ projects. We also assist with related risk management since it is critical for our clients to be able to anticipate, identify and manage litigation risks. Our expertise is specifically recognized for complex compliance issues – since compliance today implies very tangible legal (and often criminal) legal risks: human rights, ESG, AML/CFT, data privacy – international investors must be aware of, and factor in, the increasingly dense compliance framework.

You maintain offices in Switzerland, Singapore and France. How has this been helpful for your clients.

This is something that has grown organically and is largely demand-driven. Having a global footprint (though, without prohibitive overheads) in a strategic and pointed manner has naturally been key to our strategy of delivering to clients.

Singapore continues to be one of the most sophisticated capital markets trusted by investors in Europe and globally. Our presence here ensures that those investors seeking such markets are well-serviced and have access to regulation and governance-rich environments. Further, much of the financial innovation is occurring in Singapore, with scalability and adaptability for the entire region. Raising “smart” finance continues to be essential for investors from Europe, thus being in Singapore is very useful for our client base.

Finally, our offices in France and Switzerland, at the heart of Europe, are absolutely complementary to our Singapore practice. They serve our outbound Asian clients. They also provide a one-stop shop option for our European clients active in Asia (or looking to explore Asia’s new markets). Together, our network spans 70+ lawyers, 7 offices, a dozen languages – with a full practice offering and recognized experts in dedicated practice areas such as the medtech/biotech and international arbitration.

Tell us about what makes your practice unique.

D Sy Law is a 100% woman-owned, projects-focused law firm – a unique proposition.

Our innovative woman-led model emphasizes collaboration and mutualization. We build tailored teams for each project, with, here again, a majority (and even at times 100%) woman team target.

Our deal-team approach is born from our clients’ trust to select for them the best legal specialists for each industry and/or sector. This proposition aims to bring the best of the private practice and in-house experience.

Our team members have often held senior positions in-house. They can relate to our client’s expectations. They understand the projects’ underlying commercial drivers. They understand the internal dynamics. They have also worked on legal aspects of projects which external counsels do not often see. Our experts therefore have unique, first-hand experience of our clients’ industry-specific legal needs.

By way of example, we recently acted as international legal advisors to an international consortium on a maiden airport privatization in a regional jurisdiction. My co-counsel on this transaction, one of the leading authorities in the aviation sector and an acclaimed independent female practitioner, was for many years the global general counsel of a world-leading airport operator. Our industry-specific expertise was evidently key in fostering a trust relationship with the client’s teams.

It also helps that we have known our experts and partner law firms for years. Many are former colleagues or co-counsels. We have prior experience working together. We operate seamlessly. Our clients enjoy a one-stop shop support as a result – from day one. This also means that our clients know exactly who will be advising on their projects. Because our proposals are centered on individual experts, rather than a brand – our clients know that they will receive individualised support throughout their project.

Our network extends to finance or engineering specialists, who are often advising development institutions, governments and the private sector in creating the next generation of collaborative projects. They bring the latest innovative approaches to any project, drawing not only on experiences from around the world, but also the ability to structure these for local adaptation of laws, regulation and infrastructure.

In times where projects require increasingly technical, cross-industry expertise, we aim to bring an alternative to the traditional law firm model, centered on flexibility and innovation.

How have you incorporated innovation into your practice

Innovation is no longer a “desirable” aspect of conducting business, rather a necessity, in our view. It is “smart” business. Hence, it forms the very basis for how we operate as a practice, as well as figuring substantially in the solutions that we structure for them – core values that enhance our adherence to ethical, environmentally sound and client-friendly action.

At the practice level, this translates across the instruction cycle, and I will give three examples:

First, data privacy. Data privacy is not just another practice area for D Sy Law, it is at the core of how we practice. We have prioritized clients’ data privacy in our set-up from day one. Our profession is premised on our clients’ trust, it is non-negotiable. Many of our clients are also based in Europe and expect GDPR-level compliance. This drives our operational choices in how we collect, store and share client information. I will not give details here, other than to say that all our client communications are protected by zero-access and end-to-end encryption, and all client data is of course stored remotely – allowing us to work from any location with the same standards.

Second, fees. D Sy Law aims to offer innovative fee structures that are flexible to meet client needs at each stage of their project life-cycle. We are able to propose such structures because we made the choice to operate a lean organisational and physical structure with limited overheads. We charge our clients for our services only (and not the high fixed costs, which we have opted to forego). This is part of our commitment to transparency.

Third, agility. Our lean structure gives us the agility and mobility that our clients need, operating hand-in-hand with them for maximum efficiency and opportunity to consult as ideas arise, rather than with a time-delay. We are fully digitalized and therefore mobile. Our teams can be embedded in our clients’ offices or on a project site, if needed. Our local presence means that there is no time lag from the moment we are instructed and our global spread allows us to maximize client availability.

With regards to business solutions, as noted earlier, our location, contacts and local partners allow us to keep our finger on the pulse of latest financial, legal and regulatory innovation across sectors. We aim to thus propose these innovations, wherever relevant, to try and facilitate a smarter, quicker or more streamlined solution for out clients.

What current opportunities and dangers exist for clients doing business or investing between Asia and Europe

As mentioned above, the current issues facing global capital markets, investors and businesses drive our practice. Environment and climate change – and the global drive towards sustainability underlies our practice.

In our view, growth in legal demand over the next couple of years will be centered around specific subsets of expertise:

- Environment. With several countries in ASEAN developing greener policies in the post-covid world, there is a great demand for such technology and innovation from sources in Europe, as well as opportunities for joint development of new solutions. Carbon credits and ESG-labeled products are among such solutions. This is correlated with an exponential growth in ESG litigation – also an area where our expertise is being sought.

- Climate change. During the past few years, awareness of climate change outcomes and disaster management operations has led to a growth in investments in green, blue and biodiversity projects from global capital markets and businesses. A substantial number of such projects are in Asia, and will accelerate in coming years. A number of our European clients are looking to capitalize and participate.

- Health. The Covid pandemic has focused global attention on healthcare, for both the public and the private spheres. The globalization of such healthcare issues has meant that investments are necessary to strengthen supply chain security and transparency – we are keenly aware of since we advised on complex, transnational Covid PPE supply chain litigations. This concern has translated into higher interest from investors to go to the origins of essential supply chains and identify long-term sustainability solutions.

I contributed as institutional and regulatory advisor to the Asian Development Bank (ADB)’s benchmark report on ‘Accelerating Sustainable Development after COVID-19: The Role of SDG Bonds (https://www.adb.org/publications/sustainable-development-after-covid-19-sdg-bonds). This report highlights the challenges in a post-Covid world and the opportunities created by Sustainable Development Goal (SDG) bonds. It provides an overview of SDG bonds as a mechanism to help mobilize the financing required to achieve the SDGs.

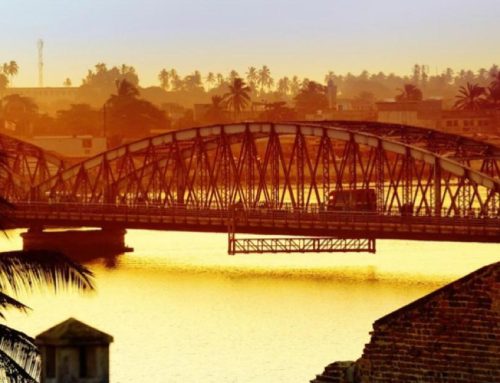

Many of the solutions proposed in ADB’s report are replicable in Africa. The synergies between Africa and South East Asia are evident. Africa is, together with the ASEAN region and India, among the most affected by climate change. The cross-continent mutualization of solutions is an opportunity.

Our firm has built unique experience advising Asian investors in Africa – and in French-speaking Africa specifically. This has also led me to cofound the Connect Africa South East Asia platform (https://connectafrica.com.sg) – which I am proposing to discuss here on a next occasion. Our upcoming events will focus on OHADA law and African civil laws in the context of inbound Asian investments.